In financial advice, some of the most important conversations are about protection, legacy, and the people who matter most. Succession advice builds directly on this foundation, ensuring wealth and responsibilities are passed on with care and intention.

For advisers who began their careers as risk specialists, this evolution feels natural. The skills are already there – understanding family structures, addressing uncertainty, and guiding people through complex but deeply personal decisions. Succession planning simply extends that work into the broader question of how to protect families and businesses across generations.

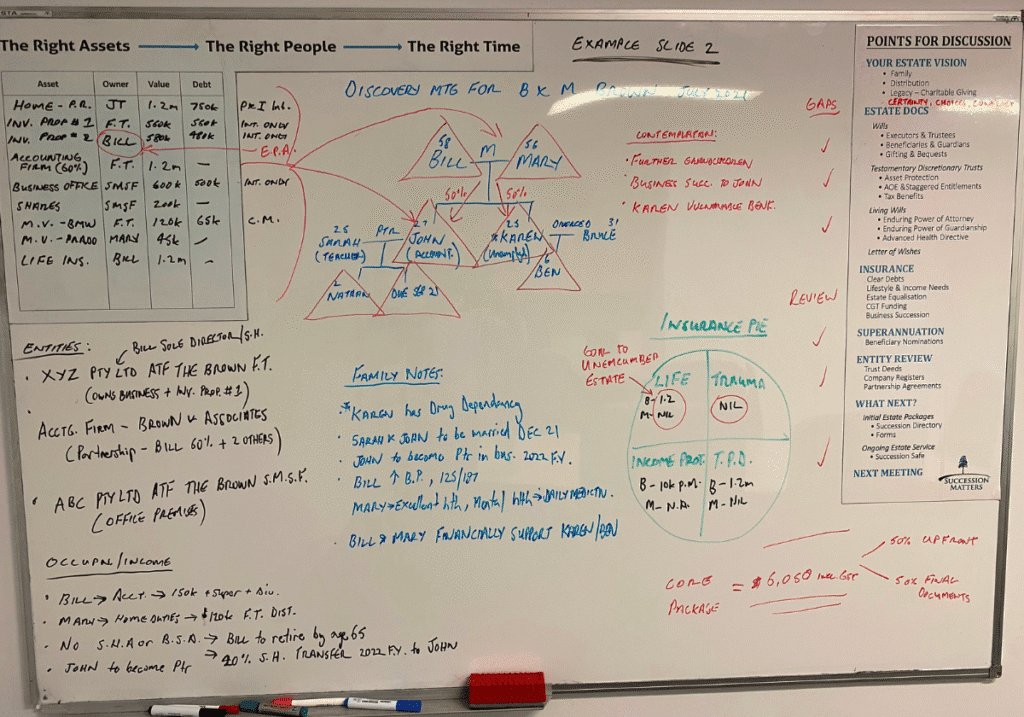

The Discovery Meeting: Drawing the Client’s World

One of the most effective ways to start these conversations is through a Discovery Meeting. Often done around a whiteboard, it allows families to see their world – relationships, assets, and obligations – mapped out clearly. This helps identify gaps, align intentions, and spark real conversations about what matters most.

Key Areas of Focus

Succession planning isn’t just about documents and dollars. It is about people and their futures. Common discussion points include:

- Blended family complexities – balancing fairness and equality across households.

- Testamentary trusts – safeguarding inheritances from creditors or relationship breakdowns.

- Non-estate assets – aligning trusts, SMSFs, and business structures with estate intentions.

- Insurance strategies – using cover to equalise inheritances when asset values differ.

- Choosing key roles – appointing executors, trustees, and guardians who combine skill with care.

- Supporting vulnerable beneficiaries – planning for children with challenges such as mental health or addiction.

- Letters of wishes – not binding, but powerful in explaining decisions.

- Contemplation clauses – preparing for future events such as marriage, divorce, or new ventures.

- Generational wealth and legacy – planning beyond today to support children, grandchildren, and charitable causes.

Why It Matters Now

Australia is entering one of the largest intergenerational wealth transfers in history, with more than $3.5 trillion expected to move from those aged 60 and over. Ensuring this wealth reaches the right people, at the right time, and in the right way has never been more critical.

In Summary

Succession advice is about more than technical expertise. It connects the financial with the personal, helping families plan with clarity and confidence. For many, it is the next step after protection planning – ensuring today’s security becomes tomorrow’s legacy.

If you are thinking about the future of your family or business, succession advice can provide the structure and peace of mind to protect both.