Life Insurance, Total and Permanent Disability (TPD) and Trauma cover all do different jobs, but the way they are set up can make a big difference to how well your overall plan works. Many policies offer features that help fit your cover to your needs, manage cost, and keep your protection in place over time.

Some features are about how benefits interact. Others help restore cover after a claim. And some allow you to structure things so different types of cover support different purposes. This guide explains these ideas in simple terms so you can understand how they might apply to your own situation.

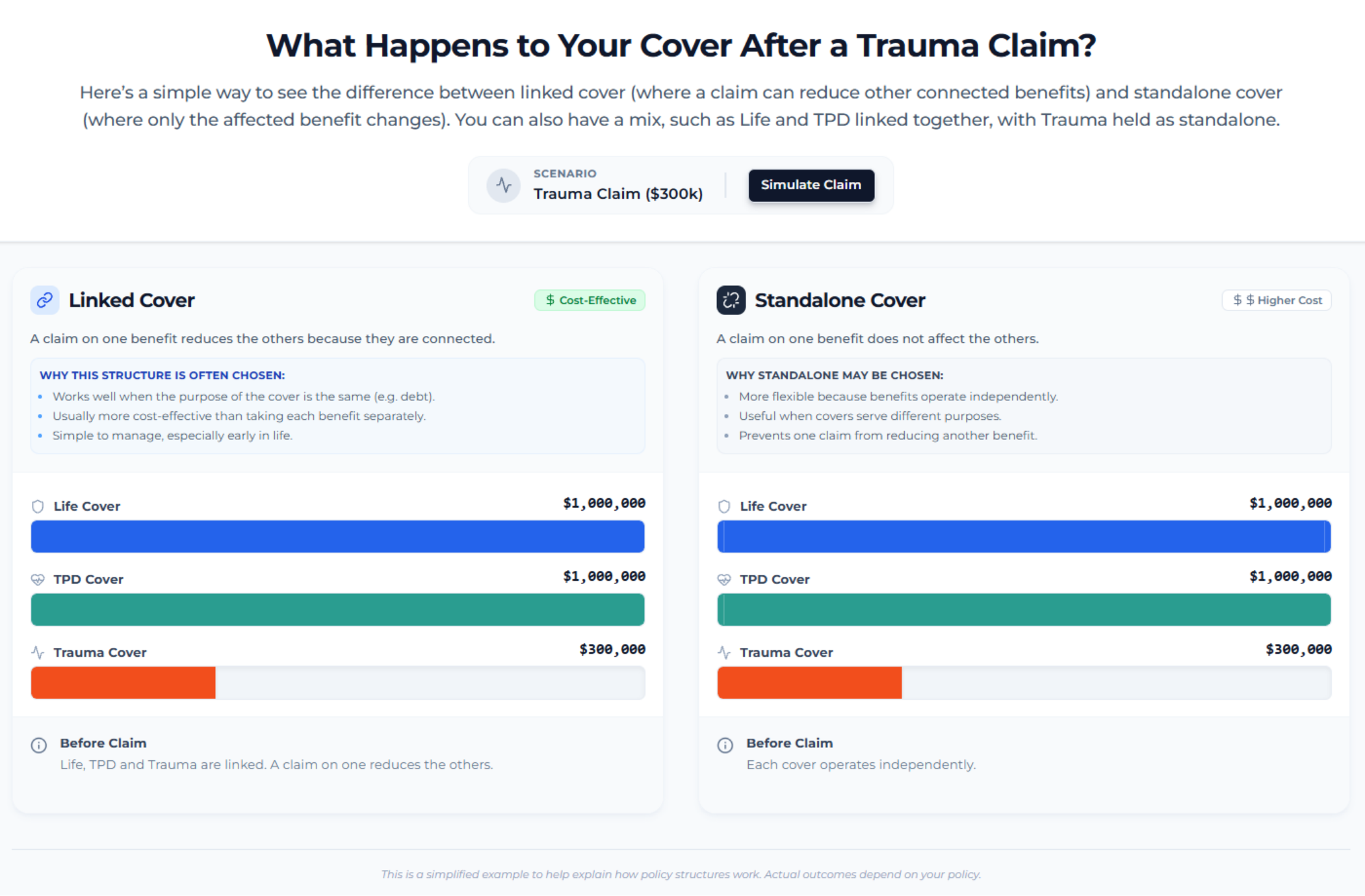

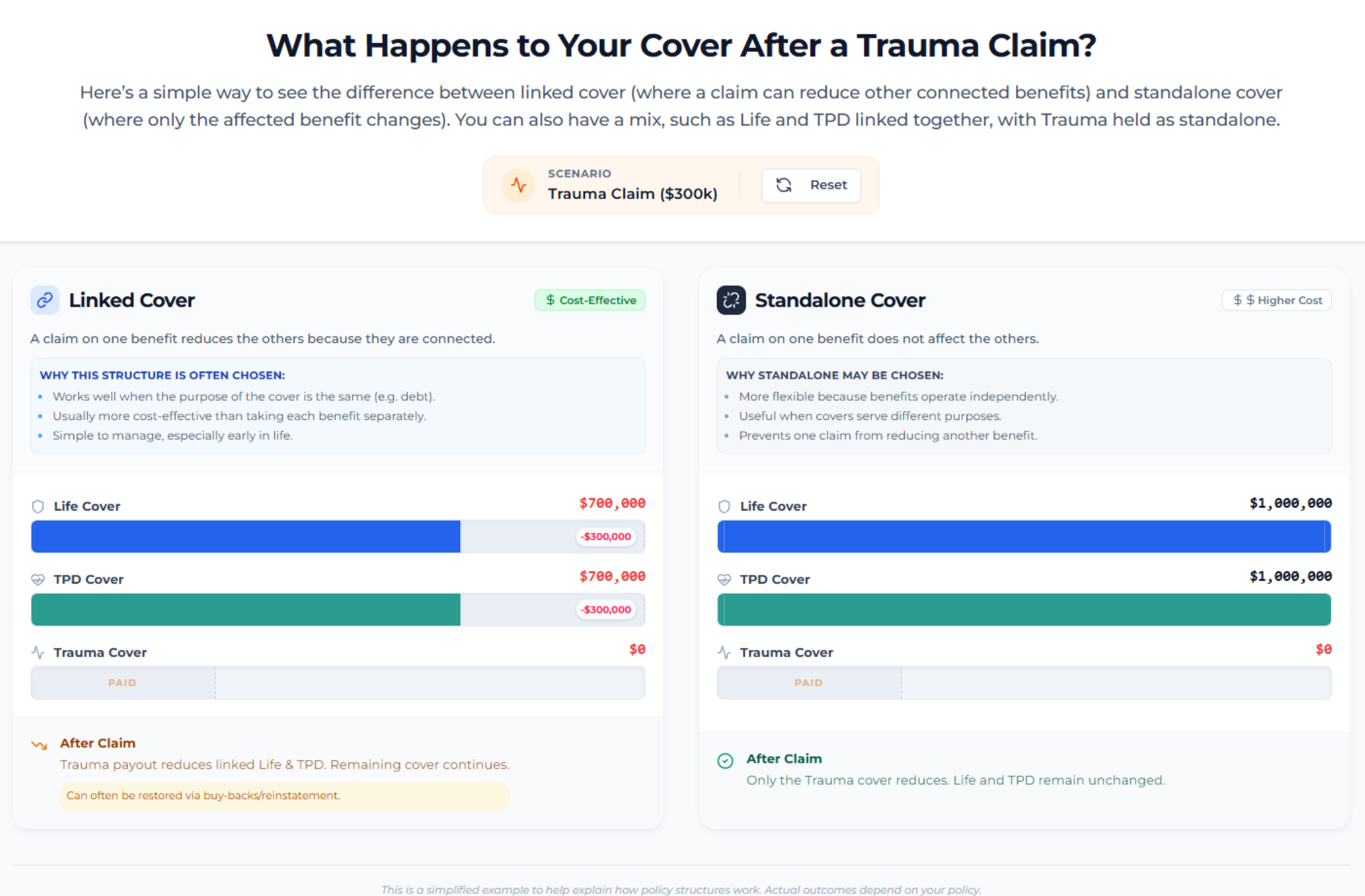

1. Linked vs standalone cover – choosing how your benefits work together

This is one of the biggest structural choices in life insurance planning.

Linked cover

Linked cover means certain benefits are connected. If you make a claim on one, the linked benefits reduce by the same amount.

This structure often works well when the purpose of the cover is the same, such as protecting the mortgage, major debts or a family’s financial security. It is usually more cost-effective than holding each cover separately.

Simple example:

If Life, TPD and Trauma are linked and you receive a Trauma payment, your remaining Life and TPD cover will reduce by the amount paid.

Standalone cover

Standalone cover means each benefit operates independently. A claim on one benefit does not affect the others.

This is often chosen when different types of cover serve different purposes. For example, someone may hold:

- Life and TPD linked (to protect debts and long-term financial security)

- Trauma as standalone (to help with medical treatment, recovery or time off work)

Standalone cover generally costs more, but offers greater flexibility and predictability after a claim.

2. Trauma reinstatement – restoring your Trauma cover after a claim

If you claim on Trauma cover, the benefit usually reduces to zero. A Trauma reinstatement option allows your Trauma cover to be rebuilt after a waiting period (often 12 to 36 months) without needing new medical evidence.

Why this can matter:

If you later suffer an unrelated serious illness or injury, a reinstated Trauma benefit means you still have protection.

Example:

You use Trauma cover to help with treatment following a cancer diagnosis. Two years later, you experience a stroke. Because your Trauma cover was reinstated, you may still be eligible to claim.

3. Buy-back options – rebuilding Life or TPD after a Trauma claim

When Life, TPD and Trauma are linked, a Trauma claim typically reduces the linked Life or TPD amounts.

A buy-back option allows the reduced cover to be restored after a set period. The timeframe varies by policy but is often from 14 days to 1–3 years. Like reinstatement, buy-back does not usually require new health information.

Why people choose it:

It is a cost-effective way to keep long-term Life or TPD protection in place even after needing to claim Trauma earlier in life.

4. Double TPD – restoring Life cover after a TPD claim

Despite the name, Double TPD is not two TPD payouts.

Instead, when Life and TPD cover are linked and you make a TPD claim, the linked Life cover usually reduces. A Double TPD feature restores the Life cover shortly after the TPD benefit is paid (often within 14 days).

Why this helps:

It ensures your family’s Life cover remains in place, even after a major disability claim.

5. How these features help build the right plan

The value of these insurance features is not in adding complexity. Their purpose is to help you:

- match cover to your goals

- manage cost while keeping key protections in place

- maintain cover after a claim without restarting underwriting

- build a long-term structure that supports you across different life stages

Some people keep things simple with fully linked cover. Others prefer standalone Trauma with linked Life/TPD. And some rely on reinstatement or buy-back options to balance cost and long-term protection.

There’s no single “best” approach. What matters is choosing a structure that fits your needs, your goals and your budget.

A simple before and after

Here’s a simple example showing how a Trauma claim can change your remaining cover.

6. When to seek help

An adviser can help you understand which structure works best for your circumstances, how different features operate, and whether your current mix still suits you. They can also explain how claims interact, what happens to your remaining cover and when features like reinstatement or buy-back may come into play.

If you’d like guidance, speaking with a qualified adviser can help you build a structure that supports you now and adapts as life changes.